Now that you’ve “met” another member of our Investment Committee, we’d love for you to challenge them on any thoughts or questions that you’d like to have answered in preparation for our next Barside Chat. Please reach out to your advisor if there’s something you’d like them to address.

We hope you enjoy our latest installment of Maslow Wealth Barside Chat.

Midyear Review: Stocks Maintain Momentum at Year’s Halfway Point

The beginning of 2024 started out a lot like the end of 2023, with markets rising amid talk of a potential decrease in US inflation and interest rate cuts from the Federal Reserve that could follow. But much like last year, those expectations remained unfulfilled, as core inflation fell slightly but held above 3% and the Fed stood pat on interest rates.1 US stocks as measured by the S&P 500 rose to a series of record highs in the year’s first half, and the benchmark 10-year US Treasury bond yield approached 5% in the spring before retreating.2The Fed held a key measure, the federal funds rate, steady through June at 5.25%, the highest level in more than two decades, with officials citing an effort to cool persistently high inflation.3 Meanwhile, the European Central Bank cut rates for the first time since 2019, as did the Bank of Canada.4 US core inflation was 3.4% in May, a multiyear low but still well above the Fed’s 2% target. However, it has moved in the direction policymakers have said they’d like to see it go—lower—though they indicated at their meeting in June that they expect just one rate cut before the end of the year.5

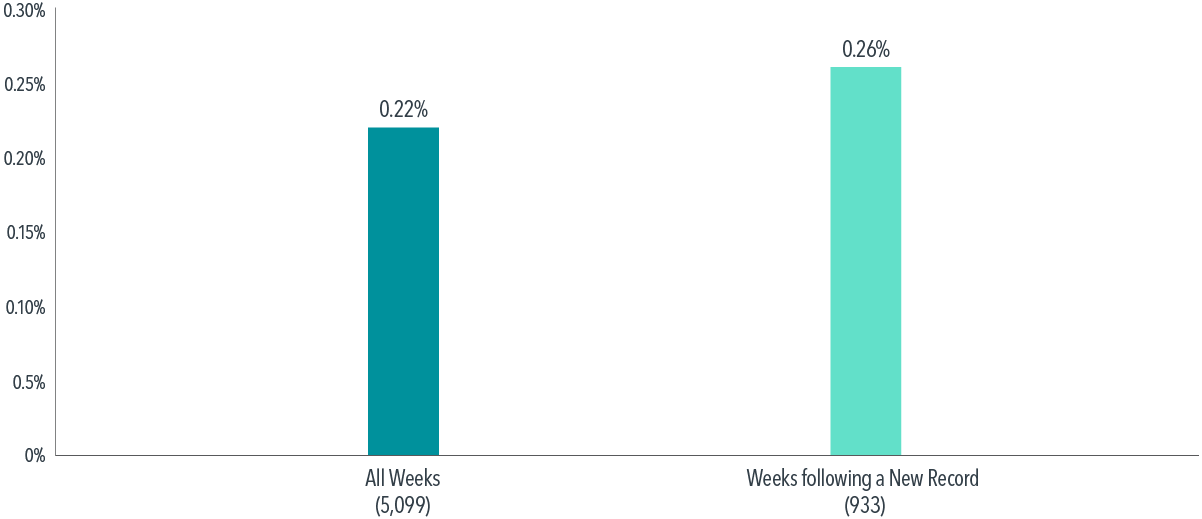

Against this backdrop, US stocks extended a bull market that began in late 2022, with the S&P 500 index gaining 14.6% through June 14 and notching new all-time highs. Record levels may lead some investors to wonder whether it’s a good time to sell, but historical data can help allay such concerns. Periodic record setting should be expected for an asset class with positive expected returns. As Exhibit 1 shows, the average return for weeks following these new highs was 0.26%—very close to the average return of 0.22% across all weeks. As long as investors demand positive returns in exchange for holding stocks, a new market high doesn’t mean the market is going to tumble.

Setting the Records Straight

Weekly returns for the Fama/French Total US Market Research Index, July 1926-March 2024

Past performance is no guarantee of future results. Indices are not available for direct investment.

Past performance is no guarantee of future results. Indices are not available for direct investment.

The strong rally in the technology sector in 2023 continued into the new year. The tech-heavy Nasdaq, after gaining 44.6% last year, has risen 18.1% this year, vs. the S&P 500’s 14.6% gain. Nvidia remained the biggest driver of gains in the tech sector through the end of May, as demand remained strong for chips used to power cutting-edge AI applications.6 But expecting Nvidia and the rest of the so-called Magnificent 7 tech stocks to outperform the broader market is to bet on them further exceeding the market’s expectations.7 Simply meeting expectations may result in returns more in line with the market, consistent with the history of top US stocks.

Global stock markets reached multiyear highs, with the MSCI All Country World Index rising 10.6% through mid-June.8 Developed international stocks, as represented by the MSCI World ex USA Index, added 4.4%, and emerging markets stocks, as represented by the MSCI Emerging Markets Index, were up 6.4%.

US Treasuries were little changed for the year, with the 10-year Treasury bond falling 1.0%. However, yields (which rise when prices fall) remained higher than they have been for most of the past decade. The 10-year Treasury yield touched 4.7% in April, after nearly reaching 5% last October for the first time since 2007, before pulling back to 4.2% as of June 14.9

Putting Premiums in Perspective

As the broader market gained, value stocks and the stocks of companies with small market capitalizations were unable to keep up with their historical outperformance. The MSCI All Country World Value Index rose 5.3%, about a third of the 15.7% increase for the MSCI All Country World Growth Index. Without help from the US tech sector, the MSCI All Country World ex USA Growth Index only rose 6.4%, still ahead of the 3.5% increase for the MSCI All Country World ex USA Value Index. Small cap companies underperformed large cap stocks globally: The MSCI All Country World Small Cap Index returned 1.3% vs. 10.6% for the larger-cap MSCI All Country World Index. But history suggests giving up on small cap value after prolonged stretches of underperformance in the past would have been a mistake.

And premiums don’t always move in lockstep, as stocks of companies with high profitability have recently outperformed the stocks of companies with low profitability. That has held true in both developed and emerging markets this year. The Fama/French Developed High Profitability Index rose 10.7% as of May 31, vs. 6.8% for its low-profitability counterpart. The Fama/French Emerging Markets High Profitability Index rose 5.4%, while its low-profitability counterpart rose 0.7% as of May 31. It’s a reminder that investors who pursue multiple premiums can increase their chances of long-term success.10

The Benefits of a Flexible Approach

Pursuing historical premiums is one way of seeking to outperform benchmark returns. Implementation—including portfolio design, daily management, and trading—is another. Every June, an event helps put this into focus. That’s when Russell US indices undergo their “reconstitution,” when the benchmarks add and drop stocks. As time goes by, however, stock prices will change; what was once a small cap might become a large cap. Revising holdings annually means those stocks are stuck in the index, regardless of their characteristics, until the following June.

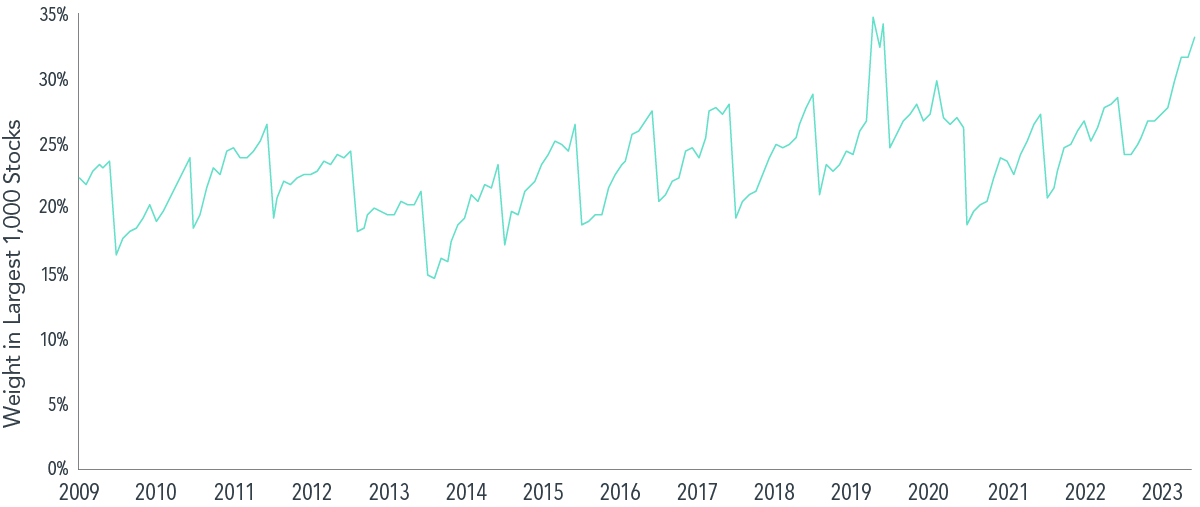

As Exhibit 2 shows, from December 2009 to May 2024, the small cap Russell 2000 Index had unsteady exposure to small caps. The percentage made up of large caps tended to rise through the year and peak before the index was reconstituted. That exposure to large caps came at the expense of a more consistent focus on small caps. In other words, investors may not have been getting what they came for. An investment process with the flexibility to evaluate and adjust holdings daily can provide a more consistent focus over time, potentially capturing premiums more reliably.

Sneak Peaks

Market cap weight of Russell 2000 Index constituents among the largest 1,000 stocks, December 2009–May 2024

Investors who diversify, focus on the premiums, and embrace a flexible investing approach will still confront uncertainties in the year’s second half. But uncertainty is unavoidable, and it accounts for the risk that can lead to positive returns. How long can the bull market endure, and which way will inflation, and interest rates, go? Will the surge for AI-associated companies continue? Will global hostilities in the Middle East and Ukraine ease or increase? Will the US election bring a big November stock swing? (Spoiler: It usually hasn’t.) We’ll find out eventually, by the time the answers are also incorporated in market prices. Until then, 2024—like every year—is a good one for having a long-term plan and sticking with it.

INDEX DESCRIPTIONS

Results shown during periods prior to each index’s inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

Fama/French Developed High Profitability Index: Provided by Fama/French from Bloomberg data. Includes stocks in the upper 30% operating profitability (OP) range in each region; companies weighted by float-adjusted market cap. Rebalanced annually in June. OP for June of year t is annual revenues minus cost of goods sold; interest expense; and selling, general, and administrative expenses, divided by book equity for the last fiscal year-end in t – 1.

Fama/French Emerging Markets High Profitability Index: July 1991–present: Fama/French Emerging Markets High Profitability Index. Courtesy of Fama/French from Bloomberg and IFC securities data. Includes stocks in the upper 30% operating profitability range in each country; companies weighted by float-adjusted market cap; rebalanced annually in June. OP for June of year t is annual revenues minus cost of goods sold; interest expense; and selling, general, and administrative expenses, divided by book equity for the last fiscal year-end in t – 1.

Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Kenneth R. French – Data Library (dartmouth.edu)

FOOTNOTES

1. Inflation data as defined by the Consumer Price Index (CPI) from the US Bureau of Labor Statistics; the “Consumer Price Index for All Urban Consumers: All Items Less Food & Energy” is an aggregate of prices paid by urban consumers for a typical basket of goods, excluding food and energy. This measurement, known as “Core CPI,” is widely used by economists because food and energy have very volatile prices. Source: Federal Reserve Bank of St. Louis. 2. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved; Caroline Valetkevitch, “Nasdaq, S&P 500 post all-time closing highs for 4th day as tech boosts,” Reuters, June 13, 2024. 3. The federal funds rate is the overnight interest rate at which one depository institution (like a bank) lends to another institution some of its funds that are held at the Federal Reserve; “Federal Reserve issues FOMC statement,” Federal Reserve, June 2024. 4. Jenni Reid, “European Central Bank cuts interest rates for the first time since 2019,” CNBC, June 6, 2024; “Bank of Canada reduces policy rate by 25 basis points,” Bank of Canada, June 2024. 5. “Federal Reserve Board and Federal Open Market Committee release economic projections from the June 11-12 FOMC meeting,” Federal Reserve, June 2024. 6. Asa Fitch, “Nvidia’s Sales Triple, Signaling AI Boom’s Staying Power,” Wall Street Journal, May 23, 2024. 7. The Magnificent 7 stocks include Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. Named securities may be held in accounts managed by Dimensional. 8. MSCI data © MSCI 2024, all rights reserved. 9. Return based on the Bloomberg US Treasury Bond Index. Bloomberg data provided by Bloomberg Finance LP. Source for US Treasuries: US Treasury. 10. Wei Dai and Namiko Saito, “Pursuing Multiple Premiums: Combination vs. Integration” (white paper, Dimensional Fund Advisors, February 2021).

DISCLOSURES

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data copyright MSCI 2024, all rights reserved. S&P data copyright 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment, therefore their performance does not reflect the expenses associated with the management of an actual fund.

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

UNITED STATES

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value Dimensional Fund Advisors does not have any bank affiliates.

CANADA

These materials have been prepared by Dimensional Fund Advisors Canada ULC. The other Dimensional entities referenced herein are not registered resident investment fund managers or portfolio managers in Canada.

This material is not intended for Quebec residents.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise noted, any indicated total rates of return reflect the historical annual compounded total returns, including changes in share or unit value and reinvestment of all dividends or other distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

AUSTRALIA

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that have been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.

NEW ZEALAND

This material is issued by DFA Australia Limited (incorporated in Australia, AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. This material does not give any recommendation or opinion to acquire any financial product or any financial advice product, and is not financial advice to you or any other person. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and for the Dimensional Wholesale Trusts the target market determination (TMD) that have been made for each financial product or financial advice product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.

WHERE ISSUED BY DIMENSIONAL IRELAND LIMITED

Issued by Dimensional Ireland Limited (Dimensional Ireland), with registered office 3 Dublin Landings, North Wall Quay, Dublin 1, Ireland. Dimensional Ireland is regulated by the Central Bank of Ireland (Registration No. C185067). WHERE ISSUED BY DIMENSIONAL FUND ADVISORS LTD.

Issued by Dimensional Fund Advisors Ltd. (Dimensional UK), 20 Triton Street, Regent’s Place, London, NW1 3BF. Dimensional UK is authorised and regulated by the Financial Conduct Authority (FCA) – Firm Reference No. 150100.

Dimensional UK and Dimensional Ireland do not give financial advice. You are responsible for deciding whether an investment is suitable for your personal circumstances, and we recommend that a financial adviser helps you with that decision.

Dimensional UK and Dimensional Ireland issue information and materials in English and may also issue information and materials in certain other languages. The recipient’s continued acceptance of information and materials from Dimensional UK and Dimensional Ireland will constitute the recipient’s consent to be provided with such information and materials, where relevant, in more than one language.

NOTICE TO INVESTORS IN SWITZERLAND: This is advertising material.

SINGAPORE

This material is deemed to be issued by Dimensional Fund Advisors Pte. Ltd., which is regulated by the Monetary Authority of Singapore and holds a capital markets services license for fund management.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

FOR PROFESSIONAL INVESTORS IN HONG KONG:

This material is deemed to be issued by Dimensional Hong Kong Limited (CE No. BJE760) (“Dimensional Hong Kong”), which is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

This material should only be provided to “professional investors” (as defined in the Securities and Futures Ordinance [Chapter 571 of the Laws of Hong Kong] and its subsidiary legislation) and is not for use with the public. This material is not intended to constitute and does not constitute marketing of the services of Dimensional Hong Kong or its affiliates to the public of Hong Kong. When provided to prospective investors, this material forms part of, and must be provided together with, applicable fund offering materials. This material must not be provided to prospective investors on a standalone basis. Before acting on any information in this material, you should consider whether it is suitable for your particular circumstances and, if appropriate, seek professional advice.

Neither Dimensional Hong Kong nor its affiliates shall be responsible or held responsible for any content prepared by financial advisors. Financial advisors in Hong Kong shall not actively market the services of Dimensional Hong Kong or its affiliates to the Hong Kong public.